Narrow down which payment methods to accept, and consider the geographic and demographic opportunity costs of not offering popular payment options amongst your target market.

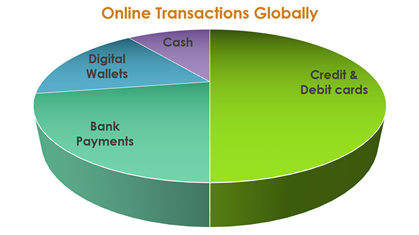

"Credit and debit cards, not always the most trusted option, only account for half of online transactions globally. Bank payments, digital wallets, and cash are in strong customer demand, and can even offer additional benefits to businesses such as lower risks and transaction costs." - Stripe: A Guide to Payment Methods

Worldwide it's estimated that 2 billion people are unbanked with "no bank account or access to a financial institution via a mobile phone, or any other device" - Business Insider. To be "unbanked" means to "rely on payday lenders or loan sharks to cash paychecks… PayPal is [now filling this void by offering] "alternative financial services … it's the first company to directly target the unbanked [a global market worth $380B]" - The Hustle

In the USA, there are more options right now for PayPal to work as a POS (Point-of-sale) system than in Canada. Find the listing of available vendors here, then go on www.sagepss.com to see if the vendor is a Sage partner with a integration solution available for Sage 50 (important if you want to have your client invoices marked paid*). You can search for US and or Canadian products. Lastly, you can contact one of our developer partners directly to hire them to try and enable the PayPal Here Card Reader to work with your PayPal business branded app which may then connect to Sage 50. Contact one of our Sage Accounting Network developer partners using the Sage Match site.

View our Q&A on Sage 50cloud: Invoice Payments, PayPal, and Bank Feeds

Note: This feature requires a Sage 50cloud subscription, here are the steps on how to set up the new Invoice Payments feature

Risks and Challenges:

Fraud and scams can occur, so how do you protect your business? Stripe: A Guide to Payment Methods provides a perfect response, stating that:

"A challenge for businesses accepting payments online is to ensure that they can provide a pleasant payment experience for their customers. A business can distinguish between three types of payments, which will shape the flow of their checkout:

- Business-initiated: The customer provides payment details to the business, who can initiate payments at their own convenience. This is the case for credit card payments for which only the card details are required, or bank direct debit payments for example. Importantly, in the case of business-initiated payments, a business may not have the ability to formally confirm that either the customer authorized the transaction, nor that the payment details were indeed provided by their owner. As detailed above, these payment methods can present additional risks of fraud and disputed or revoked payments for businesses.

-

Tip: Sage 50 CA integrates an EFT module (Electronic Funds Transfer service) which is an add-on that allows you to setup pre-authorized client payments, and pay vendors and or employee payroll. Contact our sales team at 1-888-261-9610 Monday to Friday from 6AM to 5PM PST for pricing and orders.

-

- Customer-authenticated: The customer both provides payment details and authenticates that they are the owner of these payment details. Examples include payment methods that have customers receive and type a one-time password, or that require customers to log in to their account on a separate app or website. These payments often require more complex checkout experiences, and require the explicit intervention and consent of customers for each payment but—as we’ve seen—offer businesses additional guarantees that the payment details weren’t used fraudulently, shifting the burden of liability away from them in the case of disputes.

-

Tip: If you have a Sage 50cloud subscription then set up the new Invoice Payments feature which allows you to email invoices that can be paid online by your clients.

-

- Customer-initiated: The customer is required to take all the necessary steps in order to send funds themselves to a receiving “destination” specified by the business. This is the case for bank credit transfers, in which the “destination” provided is simply a bank account. As these payment methods require the customer to take action, there may be additional delays in payments being received. However, an important benefit to businesses is that they are in principle irrevocable by customers: funds received cannot be taken back inadvertently."

Other Resources:

Was this blog useful? Kindly leave us a like and rating on the right-hand side of this page.