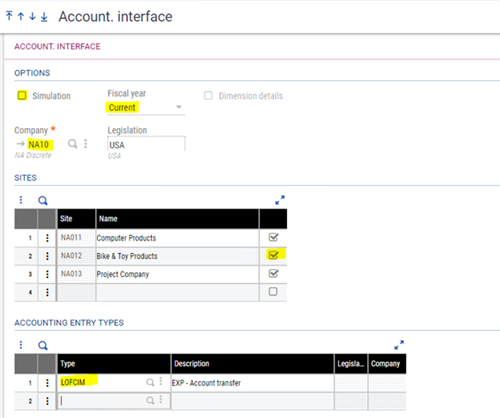

Expense: Account transfer is an Accounting entry type in Setup, Fixed assets module.

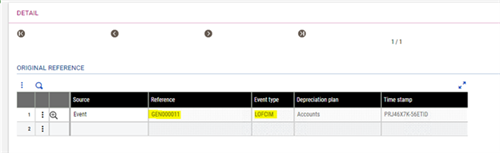

Event type LOFICM in Accounting entry types is triggered when there is an account transfer between the invoice and the capitalized expense. i.e. the GL a/c specified on the expense is different to the GL account used on the asset generated by capitalizing that expense.

LOFCIM entry types, consist of two tabs, General tab and Interface tab.

General tab consist of the setup options for the entry type and the interface tab selects a record group to be posted and loads a temporary table (TMPCPTDTA) with the necessary information for the supervisor tool to generate the accounting entry/entries. This tab is used to define loading rules for each temporary table field.

In Fixed assets, fixed assets, assets, when generating a new asset by capitalizing an expense, the invoice GL a/c is different to the asset GL a/c, it generates a record in ELOFCIM table.

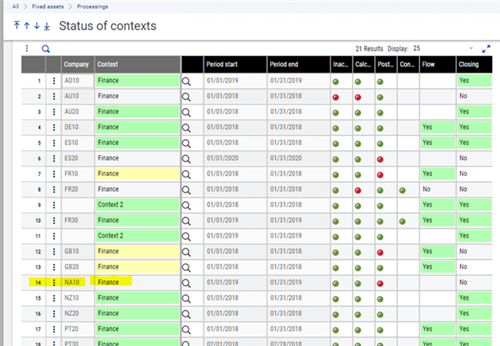

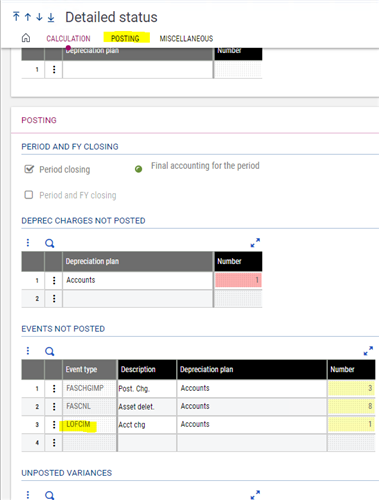

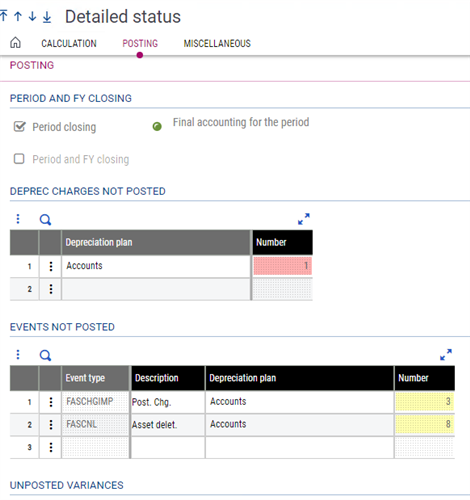

To check if the Expenditure: Account transfer has generated a record in ELOFCIM and whether it has processed an Accounting entry, check the status of context in Fixed assets, Processings, for that company under the events not posted grid.

Finally, upon running the Generation of accounting entries for event type LOFCIM, in Fixed assets, Processings, EM will generate an accounting document.

Please see below an example of how to generate a record for Expenditure: Account transfer;

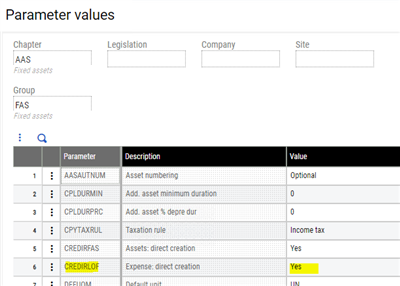

1. ADPVAL: In general parameters select AAS chapter and FAS group and set the CREDIRFAS Expense: direct creation to “Yes”.

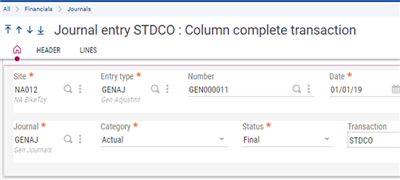

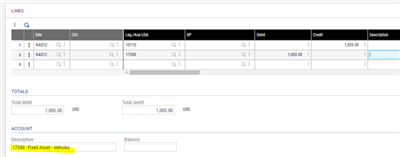

2. GESGAS: Generate a general journal entry with a fixed assets account 17300 (GESGAC) which is set to “Fixed asset tracking”, “Expense creation”, and the “Accounting nature” is set to either Fixed assets in service or Fixed assets in Progress.

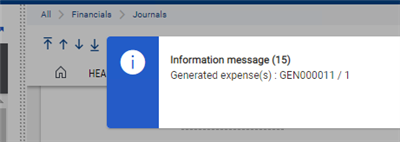

- Finalize the journal entry to generate an expense.

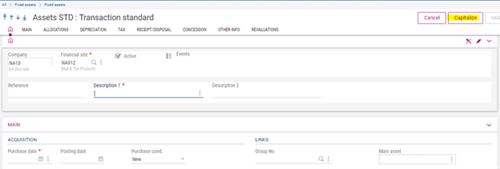

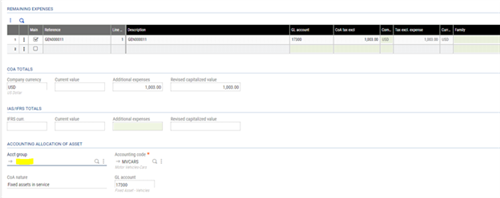

3. GESFAS: Select a Financial site where the depreciation contexts exist and click “Capitalize”.

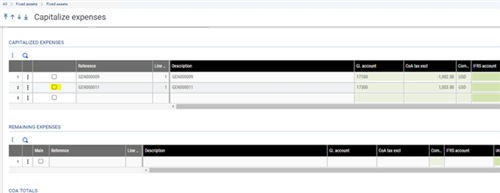

a. In the Capitalize expenses grid, select an invoice reference as a principal asset.

b. Assign an Accounting allocation by selecting an Acct group, or Accounting code.

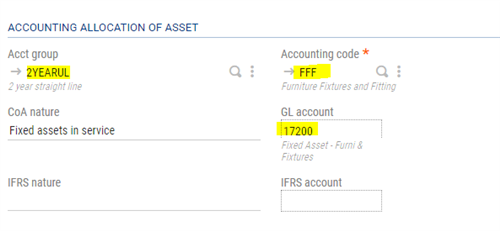

c. Default Accounting code = MVCARS.

d. New Acct group = 2-year straight line and the accounting code = Furniture Fixture and fittings.

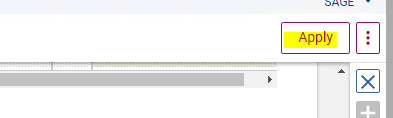

e. After selecting the accounting code click the “Apply” button.

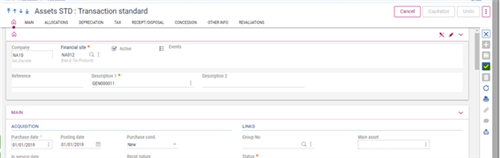

f. Asset generation

g. You can check the event type for this transaction in Fixed assets, Processings, Status of context Posting tab or under the Fixed assets screen click on the events icon.

- Click on the detail action icon selection to view the description of the asset.

4. TRTCPTINT: Generate an accounting entry for the LOFCIM event type.

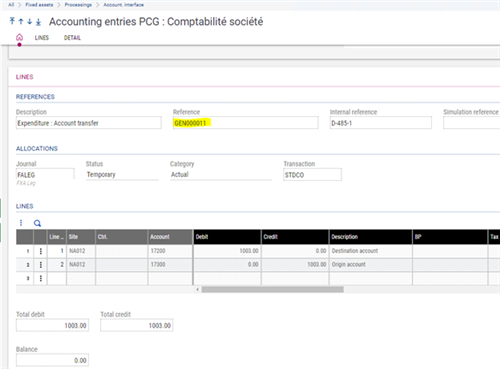

5. GESGPC: Look at the accounting entry generated by the EXP: Account transfer event type.

- Once it’s processed the line will be removed from the Events not posted grid.

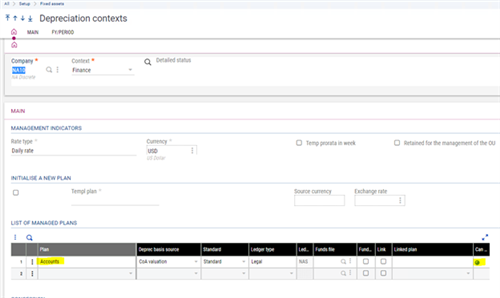

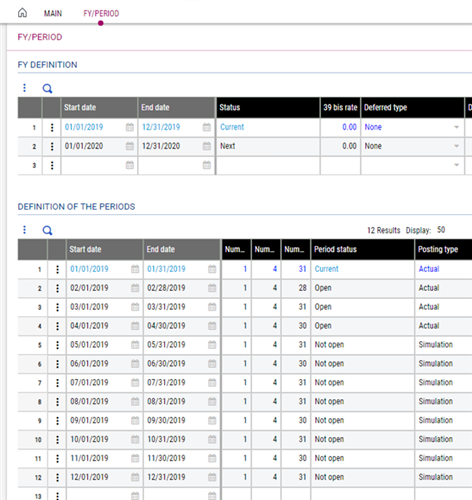

- Additional information: Depreciation context used for this example.

- One plan