Hi - I have this scenario:

Apr20/15 Purchases entered as 36 each at 5.78/ea - it should have been 3600 each at .0578/ea

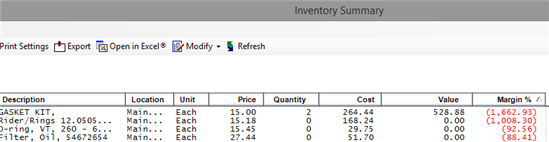

Sales between Apr20/15 and May11/15 shows - as an example - 100 ea at .15/ea and Inv/COGS at 5.78/ea (there are 19 sales invoices affected)

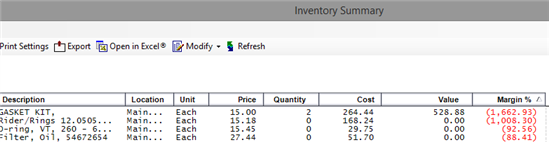

The April20/15 Purchase invoice was corrected on May11/15 to read as 3600 ea at .0578/ea and invoice date was kept at Apr20/15, and sales since May11/15 are now showing the correct Inv/COGS costs as .0578/ea

Doing an autoadjust to an Apr23/15 Sales invoice by deleting the qty of this item and re-entering the qty, then positng it did not make a different in the Inv/COGS amount - it remained the same overstated amounts.

If I reversed the same sales invoice and re-entered it exactly the same the Inv/COGS still did not change to correct amount.

Why? and what can I do to correct this? The correction I did shows at bottom of clipping below. We are using FIFO for inventory.