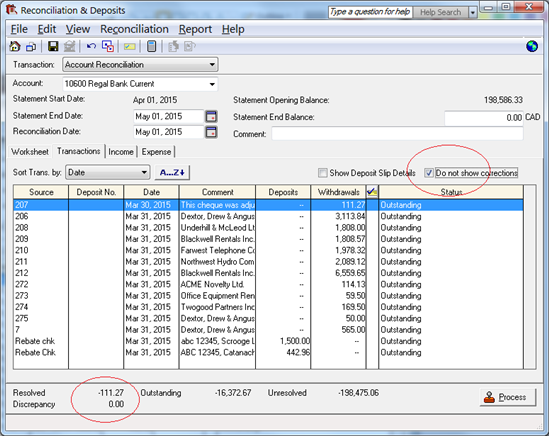

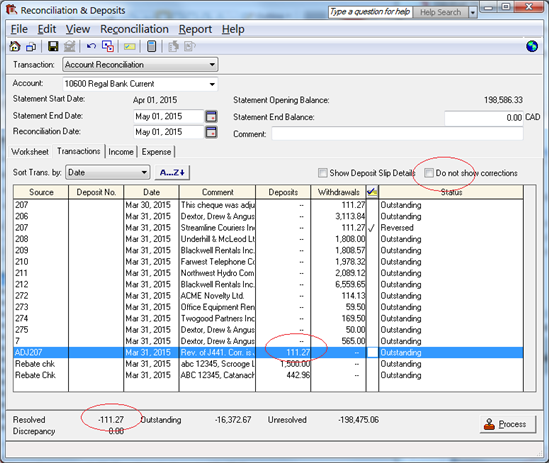

I have completed several months of bank reconciliation with no errors. Now I am starting a new month and my resolved transaction shows already a dollar amount in there before I have checked any items. so my bank reconciliation is out by that balance. Can someone advise and help on how to clear this beginning resolved transaction balance.

Sage 50 Canada

Welcome to the Sage 50 Canada Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Reconciliation and Banking

Bank Reconcillation