Yes, this problem is probably related to "linked accounts" -- and, yes, this question

has been asked maybe 8 times before -- but it seems that none of those threads

were satisfactorily answered. Either important information was missing (such as

the details or specific reasons for those Closing Entries), or the thread devolved

into some convoluted baffle-gab techno-speak that never answered the original Q.

Thus hopefully this thread will be different, with all the important details provided.

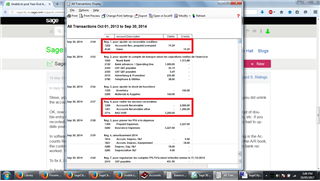

The accountant wants me to post the following as part of the FYE Closing Entries:

1200 Accounts Receivable .................................. 0.62

1202 Accounts Receivable Pre/overpaid ..... 0.61

5715 Office Expenses .................................. 0.01

One client overpaid their invoices by 61 cents -- another client overpaid by 1 cent.

(I'm not sure how the accountant got to an additional 1 cent of Office Expenses.)

I thought I had solved the overpayments by posting these entries before year-end:

1200 Accounts Receivable .......................... 0.61

4120 Sales .......................................................... 0.53

2350 GST/QST Payable ..................................... 0.08

1200 Accounts Receivable .......................... 0.01

4120 Sales .......................................................... 0.01

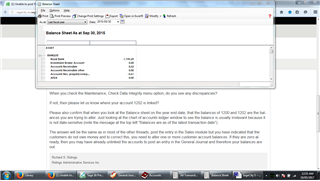

Sure enough, the "Customers & Sales" tab/homepage shows that their balances

are both $0.00. However, when I go to the "Company" tab/homepage, and then

click "Chart of Accounts", the numbers show "1200 Accounts Receivable = 0.62",

and "1202 Accounts Receivable prepaid/overpaid = -0.61". As for the other cent,

"5715 Office Expenses = 0.00". (?)

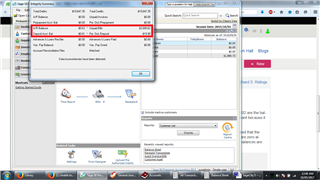

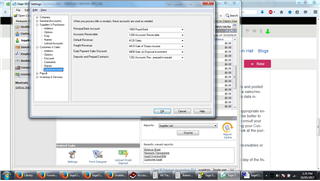

How can I input the accountant's Closing Adjusting Entry, knowing Sage refuses

to let me post General Journal entries using "1200" & "1202"? Sage does offer,

however, "1201 Accounts Receivable other" -- whose balance is currently $0.00.

Sage 50 Canada

Welcome to the Sage 50 Canada Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

Payables and Receivables

Unable to post Year-End Adjusting Entries to "1200 Accounts Receivable"