I recall asking about this last year and find myself in the same position this year.

I have received the adjusting journal entries for 2014YE from the accountant, and one of the entries posts to accounts payable. Unfortunately, one cannot post to 2100 Accounts Payable via a general journal entry (nor can one post to an A/P subledger via a general journal entry).

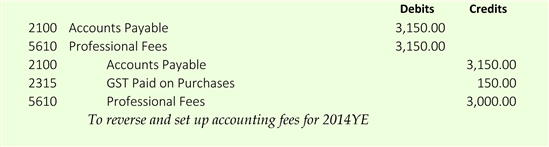

Here is the entry I have received:

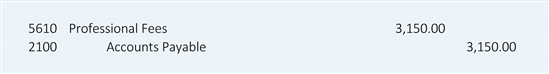

How the heck am I supposed to enter this general journal entry? Can I break it up? Maybe using the accounts payable module I do this:

but not sure how to do this... maybe I use the accounts payable module again but enter negative numbers?

Anyone able to help? And not to be thick, but I'll likely need some "clear" instructions ![]()

Thanks!

Kristine