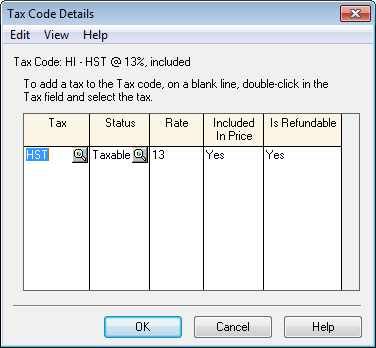

I've already created -- and successfully USED -- a Tax Code where "Sales Taxes" are INCLUDED

in many of our Bill Payments. Everything has been working like an absolute charm for weeks.

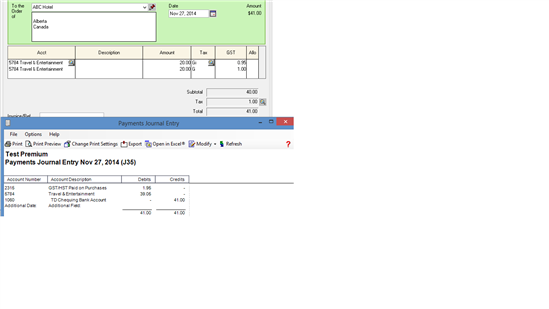

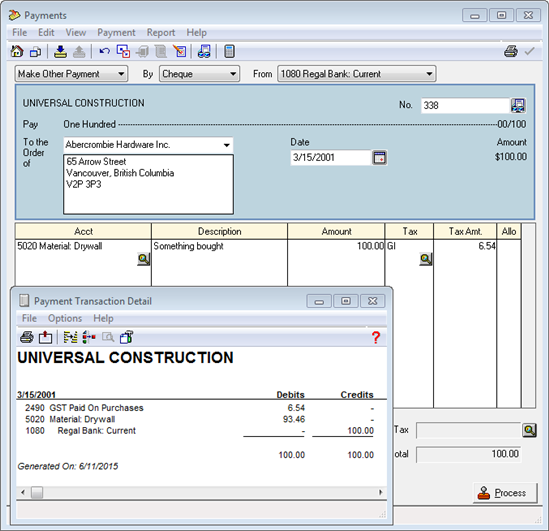

Within the "Pay Bills" module:

1) the "Tax Amount" (last column of the transaction line) always calculates & displays correctly.

2) the "Taxes" box (at the bottom-right just before "Total" and "Process") always displays correctly.

And within the Report Centre:

3) the relevant Expense and "Sales Taxes" accounts also always correctly debited & displayed.

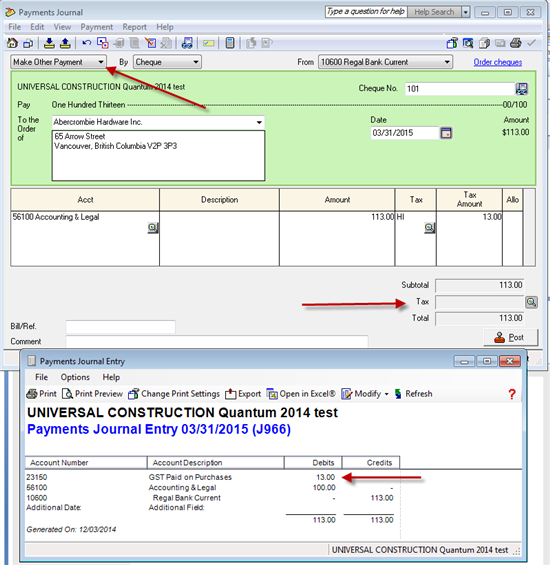

However, now all of a sudden, steps #2 and #3 no longer function, and everything in those 2 places

is posting WITHOUT Sales Taxes, even though I am using the exact same Tax Code stated above.

What gives?

It worked seamlessly for the whole financial year of Company A, and it has worked seamlessly for

the first month of the financial year for Company B. But now when I post such a payment in the

"Pay Bills" module, I cannot even MANUALLY add the Sales Taxes to the "Taxes" box in step #2.

I have dabbled back-&-forth with the "Is this tax refundable" toggle option, and there's no difference.

Please help!