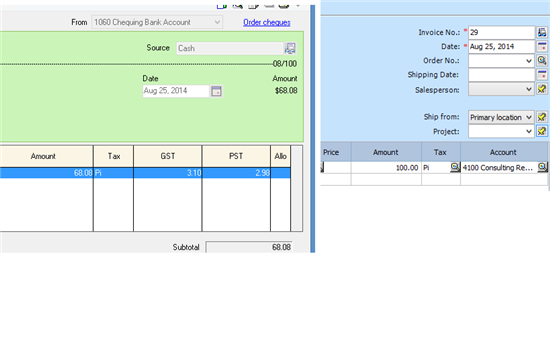

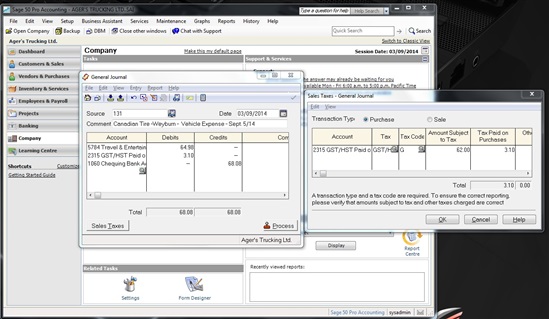

Okay so I am entering some vehicle expenses in the GJ. I have entered it as follows:

5784 Travel & Entertainment 64.98

2315 GST Paid on purchases 3.10

1060 Chequing Account 68.08

Then I need to click on the sales tax button, and it is using the "2315 GST Paid account", I have to type "G" in the "tax code" and tab over and it will calculate. The part where I am confused is that it says "Amount subject to tax" is 62.00

Now I realize I may be entering this wrong because the 64.98 amount actually has the PST in there, but the GST amount is still the amount charged on the subtotal. Now even if the program was some sort of super computer mind reader and knew I did that, the numbers still don't add up....where the heck does the 62.00 come from?? Do I need to manually enter 64.98 or is 62.00 correct.

Attempting to add a screen shot, hopefully that works lol

Sage 50 Canada

Welcome to the Sage 50 Canada Support Group on Community Hub! Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros.

General Discussion

Sales Tax not adding up in the General Journal