Hello everyone,

In my business I often have to import products that I am reselling to my customers. The shipping companies I use, such as FedEx, take care of clearing the goods through customs for which they then send me an invoice that looks like the following

GST Canada $344.28

Advanced clearing $ 10.00

GST for accessories/ANT $ 0.50

QST for accessories/ANT $ 1.00

TOTAL $355.78

Standard invoices are easy enough to manage. but invoices such as the above have got me lost. Reason why is the 1st line is evidently the GST tax, which I pay on imported shipments and am allowed to claim back every quarter.

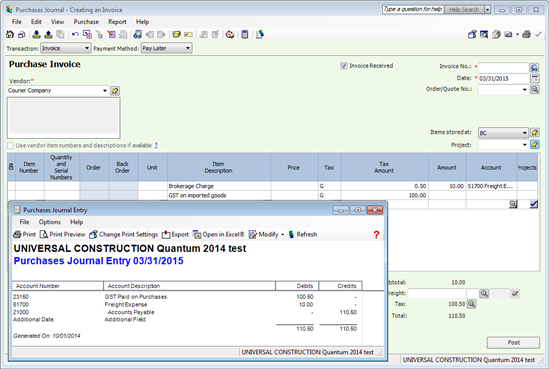

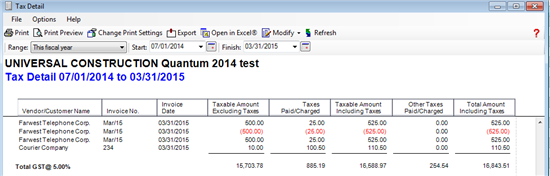

I have created FedEx as a vendor and I track duty on imported items, which is recorded in account 2115 Import Duty Clearing BUT, anyone know of a way to record invoices like the above mentioned and have the amounts recorded, so they appear in the report when comes time to remit sales taxes?

I'd hate to think Sage 50 (premium edition) can't do this and these type of transactions need to be done manually.

Please advise.

Thanks in advance to all who reply.

Cheers,

Marc