In my last blog post, “How to Reimburse an Employee Purchase through Payroll”, we talked about how to make entries for employees who pay out expenses from their own pockets on behalf of the company.

In today’s blog post, we are going to talk about sales to employees and how to deduct the payments from employees’ paycheques. Once again, thank you so much for RandyW’s valuable tips and suggestions to tackle this entry.

In our example today, we are going to use the employee, Ashcroft Howard L., in the sample company. We will first setup a deduction for the employee sales. Then, we will do a zero sales invoice to record the revenue and the sales taxes. Finally, we will deduct the employee sales from the employee paycheque.

Setup Deduction

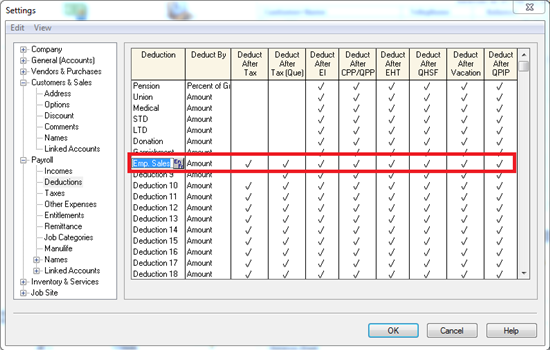

We go to Setup, Settings, Payroll, Deduction. We rename one of the extra deduction fields to Emp. Sales. For Deduct By column, we use Amount. Since we want this deduction to be taken off on the net amount, we are going to put check marks to all the remaining columns. The settings should be the same as the screenshot below.

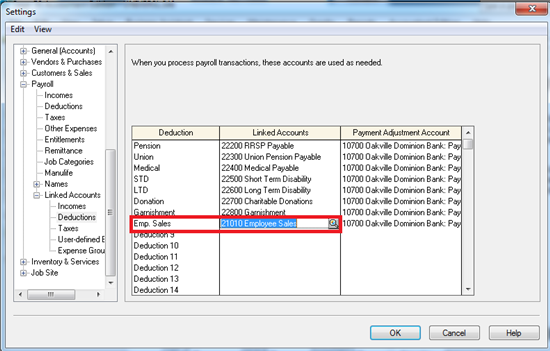

Please do not forget to go to Setup, Settings, Payroll, Linked Account, Deductions to link the new deduction. In our example, We create a new liability account called Employee Sales.

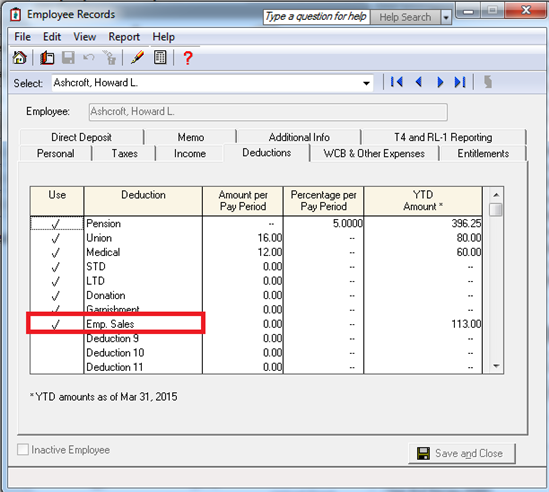

Finally, please go to individual employee’s record, Deductions tab and put a check mark under the Use column for the new Emp. Sales deduction.

Zero Sales Invoice

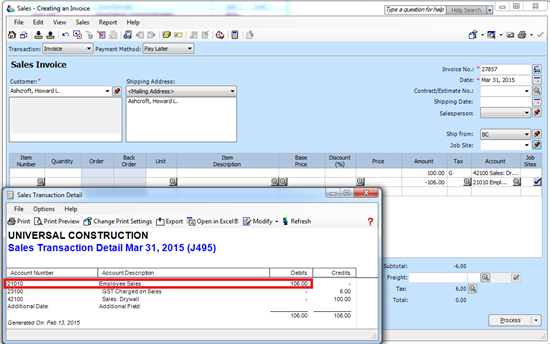

Since we sell to our employee, we are going to make the employee our customer also. Then, we open the sales invoice window and select the customer (employee) - Ashcroft Howard L. For the first line of the invoice, we enter $100 to Amount, G (6%) to Tax and 42100 Sales: Drywall to Account. On the second line, we put -$106 (negative) to Amount, no tax and 21010 Employee Sales to Account. This zero entry will debit the employee sales account ($106) and credit both the tax account ($6) and the revenue account ($100).

Deduct employee sales from the employee paycheque

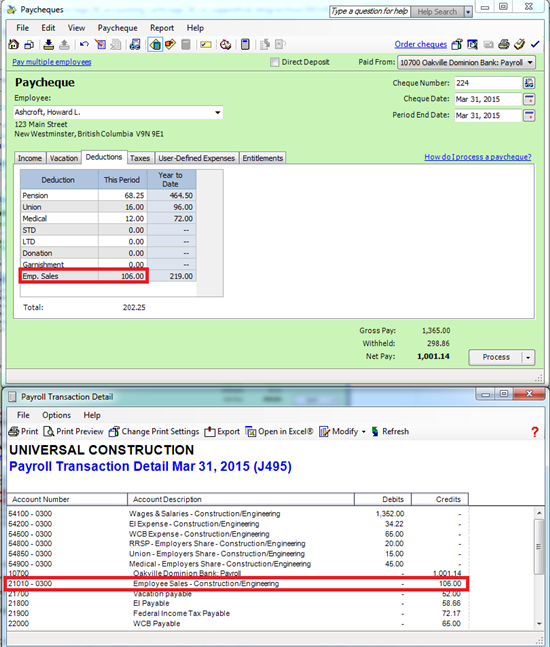

We open the paycheque window and select Ashcroft Howard L. Then, we go to the Deductions tab and key in the Emp. Sales amount, which is $106. Since the deduction is taken on the net amount, it will not affect the gross income and the tax deducted. When you open the Payroll Transaction Detail Report, the entry will credit $106 to the 21010 Employee Sales account. This will offset the debit entry from the sales invoice.

I wish this blog post is able to help you with entry involving sales to employees. Again, please give a big hand to our power user, RandyW, who shares with us such a wonderful solution.