Sage 50 R&D thrive to improve the program at customer’s request. Over the years boxes have been added to the RL-1 and T4. Those additional boxes can be printed out automatically from the application. They are accessible when printing either T4 or RL-1 slips. In the printing process there is pop-up window: T4 box options or RL-1 box options. In that window there will be a drop down menu that list additional boxes, see below:

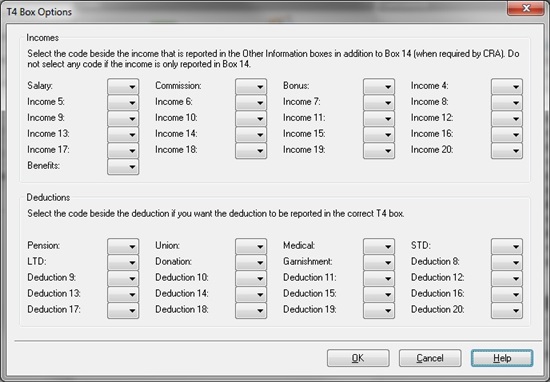

T4

Please note that Regular income created by the system will be automatically in box 14 on T4 it cannot be selected from T4 box options window, you will need to create an hourly rate income to be able to select that custom income from T4 box options.

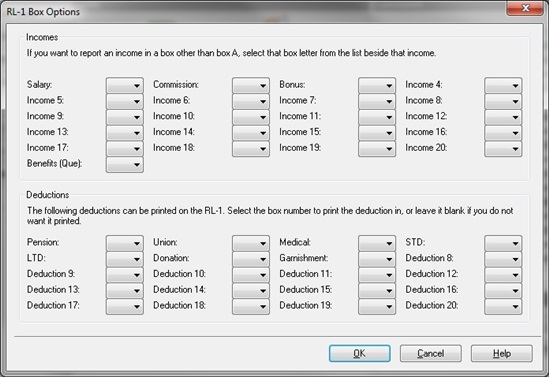

RL-1

Please note that Regular income created by the system will be automatically in box A on RL-1 it cannot be selected from RL-1 box options window, you will need to create an hourly rate income to be able to select that custom income from RL-1 box options.

As of now below are additional boxes available for T4 and RL-1 slips. New boxes can be added in future updates of the program. If you do not see a desired box on the below list you will have to manually enter it and can submit a request through Sage 50 to add it. To do that when Sage 50 is open click on Help, Contact Sage, Send us your feedback, that way you will receive a notification when the box has been added.

T4 taxable earnings and benefits

|

Box |

Description |

|

30 |

Housing, boarding, and lodging |

|

31 |

Special work site |

|

32 |

Travel in a prescribed zone |

|

33 |

Medical travel assistance |

|

34 |

Personal use of employer's automobile |

|

36 |

Interest-free or low-interest loan |

|

38 |

Security options benefits |

|

40 |

Other taxable allowances and benefits |

|

42 |

Employment commissions |

|

66 |

Eligible retiring allowances |

|

67 |

Non-eligible retiring allowances |

|

68 |

Indian exempt income — eligible retiring allowances |

|

69 |

Indian exempt income — non-eligible allowances |

|

71 |

Status Indian employee |

|

81 |

Placement or employment agency workers gross earnings |

|

82 |

Drivers of taxis and other passenger-carrying vehicles gross earnings |

|

83 |

Barbers or hairdressers gross earnings |

T4 Deductions

|

Box |

Description |

|

20 |

RPP contributions |

|

44 |

Union dues |

|

46 |

Charitable donations |

|

84 |

Public transit pass |

|

85 |

Employee-paid premiums for private health services plans |

RL-1 taxable earnings and benefits

|

Box |

Description |

|

J |

Private health services plan contributions |

|

K |

Trips made by a resident of a designated remote area |

|

L |

Other benefits |

|

M |

Commissions |

|

O |

Income from retiring allowances (code RJ) |

|

P |

Contributions to a multi-employer insurance plan |

|

R |

Status Indian employee |

|

V |

Meals and accommodation |

|

W |

Use of a motor vehicle |

RL-1 deductions:

|

Box |

Description |

|

D |

RPP contributions |

|

F |

Union dues |

|

N |

Charitable donations |