Our third improvement in Sage 50 2014 is the implementation of changes to the Manitoba sales taxes.

Effectively July 1, 2013, the Manitoba Retail Sales Tax (RST), or Provincial Sales Tax (PST) rate was increased from 7% to 8%. For more information about this tax change, you can follow the link below:

http://www.gov.mb.ca/finance/taxation/taxes/retail.html

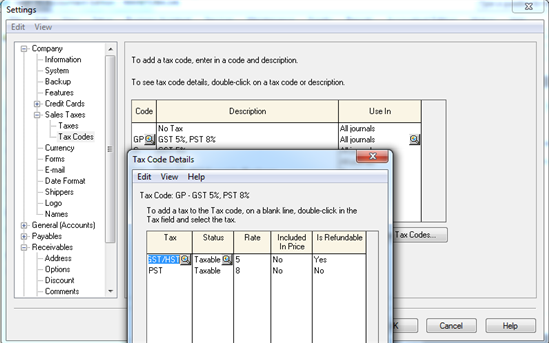

In Sage 50 2014, any new company created using the province “Manitoba” comes with the tax code GP with GST - 5% and PST - 8%. You will see the image below when you go to Setup, Settings, Company, Sales Taxes, Taxes Codes, Tax Code Details.

How about those company files created in previous Sage 50 Accounting? No need to worry. After you open the data file in Sage 50 2014, all you have to do is to go to Setup, Settings, Company, Sales Taxes, Tax Codes. First, change the description of PST from 7% to 8% for tax code – GP. Then, double click the GP code to bring up the Tax Code Details window and change the rate of PST from 7 to 8 under the Rate column. For detailed procedures and screen shot of how to manually update sales tax codes, you can follow the Knowledge Base link below:

How to update sales tax codes manually?

Hope you enjoy today’s blog post and wish everyone a wonderful Tuesday. See you later.