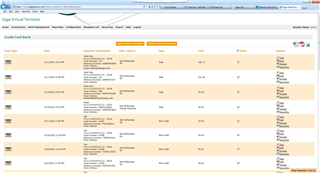

The settlement process releases a batch of transactions to the credit card processing networks for the funds to be transferred between the card holders bank and the merchants bank. This process normally occurs automatically (typically in the evening, and you can Contact the processor to change this option). Once finished the funds will have a "Settled" status.

At this point, Sage 500 does not know that the transactions have been settled. The Settle Credit Card Transactions task is used to inquire with the credit card processor to determine what transactions have been settled. It does this by comparing the transactions marked as settled with the transactions in Sage 500. Transactions that match are flagged.

The Settle Credit Card/EFT Transaction task will then create Cash Management deposits based on the information from Sage 500 for the transactions identified as settled by the credit card processor. The number of deposits generated will be displayed on the status line. Transactions are grouped by settlement batch id and deposit group. Since the settlement task is used to create Cash Management deposits for credit card payments, credit card tender types have their deposit method set to never and can only be deposited using the settlement task (CC/Set Up Tender Types).

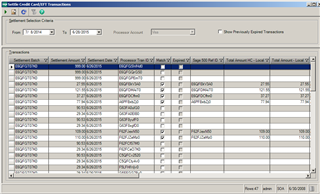

In Settle Credit Card/EFT Transaction form the columns to the left from the Match column are coming from the processor (Sage Payment Solutions), and the column to the right is coming from Sage 500. If the records are missing on the left side the likeliest reason is the transaction has not been settled yet in virtual terminal, or transaction has expired. If the records are missing on the right side the payment transaction has not been entered in Sage 500 but only in virtual terminal. And there can also be some kind of a data condition that doesn’t allow a transaction to be available for settlement. In that case please call Sage 500 technical support and we will assist you with troubleshooting.